Other financing (mainly tax effects on share-based activities) Subcategory, Cash flows from financing activitiesĬash Receipt from Issuance of Common Stock Purchases and sales of securities and other investments Subcategory, Cash flows from investing activities Other adjustments to reconcile accrual basis to cash basis Subcategory, Cash flows from operating activitiesĪdjustments to Reconcile Net Income to Net Cash Provided by Operating Activities for the year ended December 31, 2012-the year the company went public: FACEBOOK, INC. Here is a summarized version of theStatement of Cash Flows from page 74 of the annual report of Facebook, Inc. Another purpose of this statement is to report on the entity’s investing and financing activities for the period. Broadly defined, cash includes both cash and cash equivalents, such as short-term investments in Treasury bills, commercial paper, and money market funds. You can get this information only by a statement of cash flow.The main purpose of the Statement of Cash Flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. So the managers have to adopt some strategy to counter the shortfall of cash.

But when you make Cash current cash flow and projected cash flow for the next month, there will not be enough money to pay current payables of $40,000. If we analyze the above information, we will say that the company is very profitable with high sales. There is no chance of converting current receivables into cash. Projected sales for the next month are amounting to $60,000 with an expected $50,000 credit sales. At the same time, the liability side shows a payable net of $40,000. The balance sheet shows Assets side $400,000 with a cash balance of $2000 and receivables amounting to $70,000. XYZ is running its business in New York City. Let’s study an example to understand it fully. Let’s suppose an organization runs its business with a high inventory of fixed assets and high credit sales.īy analyzing the balance sheet and Profit & Loss statement, you can say that the company is very stable.īut on the other hand, there is not enough cash available to meet the organization’s expenses, which may result in bankruptcy or a decline in the company’s business. And all the financial statements are based on this information.īesides the cash flow statement, no financial report provides the actual information about the cash inflows and outflows.

Organizations use accrual methods of accounting to record their transactions.

PURPOSE OF STATEMENT OF CASHFLOWS HOW TO

Related article How to Treat Capital Reserve in Cash Flow Statement? Importance of Statement of Cash Flow: The purpose of preparing cash in the investing activities is to let the users know the items that the entity has the hug investment in and the items that the entity relax to invest in. Operating activities will let the users know whether the entity has positive or negative cash flow and the movement of each item of working capital. These are the main activities in an organization that are why changes come in cash and cash equivalents.Įach activity provides different information on the entity’s cash flow with a different purpose.

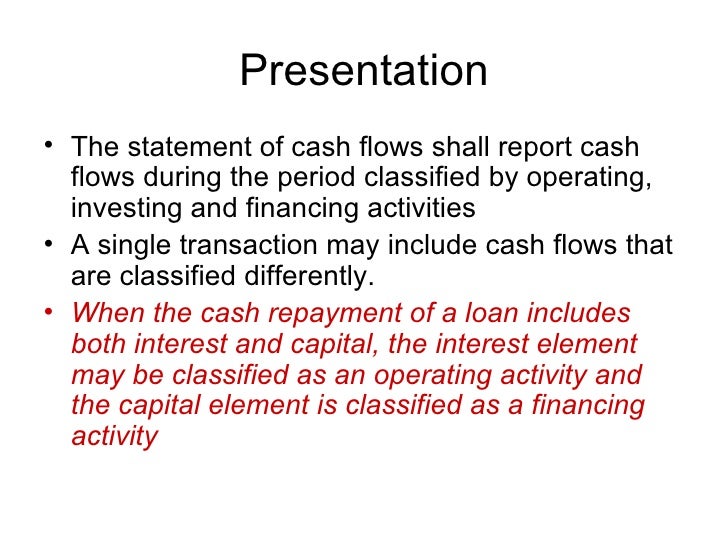

It means all the transactions should be classified under these three activities.

Advertisements Classification of Statement of CashĪccording to IAS-7, the cash flow of every organization flows under the three main heads. It also serves the same purpose as preparing other financial statements to let the users understand the entity’s financial situation, financial performance and position, and cash flow. The main purpose of making a cash flow statement is to provide the information and compare the cash receipts and cash payments during a time period in which the entity runs its business. For every business entity, the statement of cash flow should be made according to these standards. The format is described in IAS-7 and GAAP (FAS95). But for large companies and organizations, there is a proper format to be followed. In small business entities, there are no such restrictions on the format of cash flow. So it is essential to keep a record of all the cash inflow to the organization, and outflow from the organization should be kept properly. Cash and cash equivalents are the backbones of every business entity.

0 kommentar(er)

0 kommentar(er)